A taxation system is necessary to collect a share of revenue from people who use different products and services. This revenue is used for the development of the state and the country. Earlier, various taxes were used, such as excise duties, service charges, etc. One such tax system is the Goods and Service Tax India (GST), which has replaced the earlier tax regime. When people and organizations produce goods or offer services, they are tasked by their respective governments to pay GST. In this article, we explain What is GST in India in simple words, how GST works and how GST is calculated.

Quick Navigation

What is GST in India and How it Works?

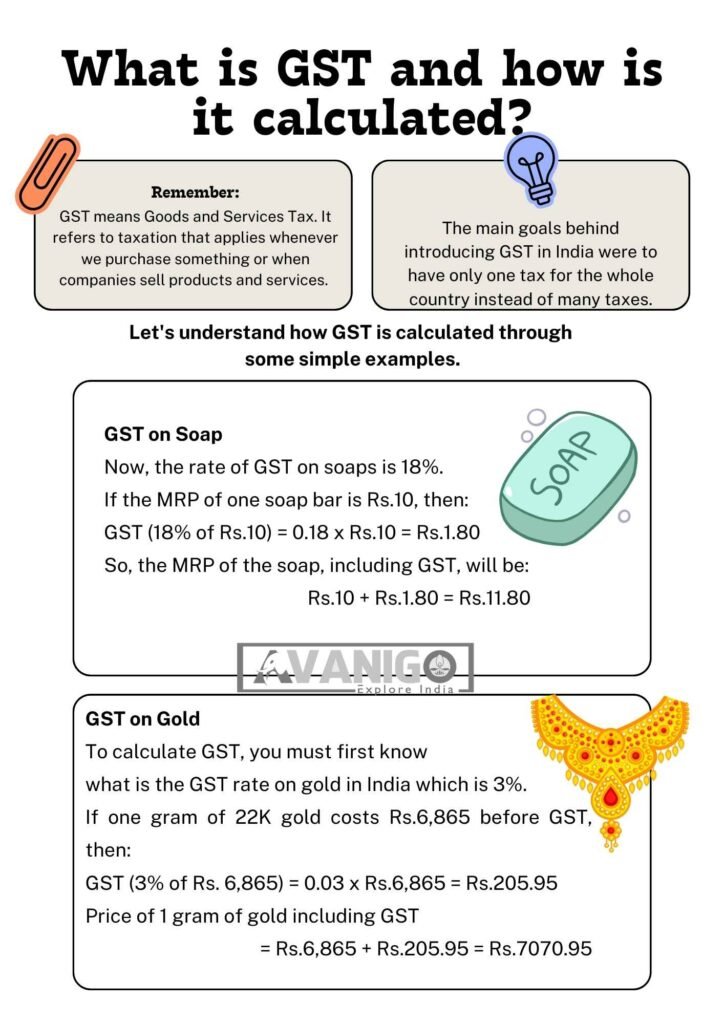

GST Meaning is Goods and Services Tax. It refers to taxation that applies whenever we purchase something or when companies sell products and services. Before the introduction of GST, different products were charged with varying taxes as we had various subjects taught in schools, but now, there is only one GST collected upon every sale by the government.

GST has made things easier for organizations as well as consumers. For example, corporations had several types of tax confusion, making it difficult for them to comply with their tax obligations. Currently, there is only one name that every entity recognizes for payment of taxes: GST. Also, from our perspective as buyers, we are free from worrying about such things as multiple commodity taxes since we pay an all-inclusive rate called GST.

What are different types of GST?

Our government first stared discussing what is GST tax in India in the year 2000. Many committees were formed to decide how it would work. Finally, after almost 17 years, GST was launched across India on 1st July 2017. Now, let’s understand What are different types of GST applicable to our country.

Types of GST in India

Based on the items and services, there are various types of GST in India as follows:

Central GST (CGST)

The collection of CGST is done based on the type of goods sold within each state by the central government. For instance, if suitcase items manufactured in Delhi find their way into a Delhi Shop, the central government shall collect CGST.

State GST (SGST)

SGST refers to that tax collected by the State Government within whose area thereof transactions occur. Again, for example, if a shop within Uttar Pradesh sells suitcases produced locally, SGST will be levied by the UP-State Government.

Integrated GST (IGST)

If items are transported from one state to another, for example, if the suitcase factory is in Haryana and sells the suitcases to the shop in Delhi, then IGST is collected by the Central Government. This helps in the smooth movement of goods across states.

Union Territory GST (UTGST)

UTGST is collected on the sale of goods and services happening within union territories of India like Chandigarh, Daman & Diu, etc, which do not have their state assemblies.

Objectives of GST

The main goals behind introducing GST in India were to have only one tax for the whole country instead of many taxes, make tax payments easy for businesses and customers, and stop hiding taxes collected by companies.

The government wanted one tax that was the same in all parts of India, whether Delhi, Mumbai, or Chennai. Earlier, different states had different taxes, which needed to be clarified. But now, the same rate of tax will be applied wherever you are in India.

It also aimed to improve the ease of doing business. Businesses had to pay many types of taxes before. With one tax, filing returns and payments will be straightforward. Likewise for us, we will save time by not worrying about different taxes for each thing we buy.

Another important motive was to stop some shop owners from hiding taxes. Earlier, they could have shown fewer sales and paid less tax. But now the whole record will be online, so no one can escape without paying complete tax. This will help the government get more money, which can then be used for people’s benefit.

Advantages of GST

There are many effects of implementing GST uniformly all over India. It has made life simpler for both companies and customers in many ways.

- For businesses, it is now easy to understand tax rules as the same rate is followed everywhere in the country. They also get the benefit of adjusting the tax paid on purchases against the tax to be deposited. This saves their money.

- For ordinary people, a single rate removes confusion regarding tax amounts. Products can be sent freely across states without any extra permit or tax check at borders. This has cut transport time for goods.

- The economy has also benefited as production is more efficient with a seamless national market. Extra money received by the government through GST is being spent on upgrading infrastructure like roads, ports, and bridges, which creates more jobs, too.

What is Pradhanmantri Jan Dhan Yojana? Learn more.

Members of The GST Council

Different people and bodies are involved in making the GST Council, which makes rules and regulations. It is decided under Article 279(A)2 of the Indian Constitution. It includes 33 members, of which two are from the central government, and the remaining 31 are from 28 states and three union territories. The following people represent the central and state:

- The Union Finance Minister

- The minister from a state who handles revenue or finance

- The finance or taxation minister, or any other minister approved by each individual state administration.

- The governor of the state where emergency rule has been proclaimed under Article 356 of the Indian Constitution can also nominate someone for this purpose.

What Is A GST Number In India?

GST is necessary for any individual or organization that trades above a specific production limit. For this, he must know what is GST number India has to apply for the GSTIN or GST Number from the GST department. It is a distinctive 15-digit code that starts with two letters as the state code and is followed by ten digits and, finally, a check digit.

For instance, a toy company based in Delhi would have a GST number such as 07DEL1234567890C1. Therefore, Delhi’s state code is 07, while 1234567890 denotes pan-based ten digits, and C1, which comes at the tail end, serves as an identifier for tax compliance purposes. With this information, the business tax records can be correlated regardless of which part of the country goods are offered for sale.

Examples of GST Calculation

GST is calculated using simple mathematics. To know How to calculate GST, use the following method:

- GST Amount = (Cost of Item x GST Rate)/100

- Total Amount to be paid = Cost of Item + GST Amount

Let’s understand how GST is calculated through some simple examples:

Example 1: GST on Soap

Now, the rate of GST on soaps is 18%.

If the MRP of one soap bar is Rs.10, then:

GST (18% of Rs.10) = 0.18 x Rs.10 = Rs.1.80

So, the MRP of the soap, including GST, will be Rs.10 + Rs.1.80 = Rs.11.80

Example 2: GST on gold

To calculate GST, you must first know what is the GST rate on gold in India which is 3%.

If one gram of 22K gold costs Rs.6,865 before GST, then:

GST (3% of Rs. 6,865) = 0.03 x Rs.6,865 = Rs.205.95

Price of 1 gram of gold including GST = Rs.6,865 + Rs.205.95 = Rs.7070.95

These examples explain how the GST amount is calculated as a percentage of the base price of any goods or service.

How Much is GST on Various Products in India?

Variable rates of GST are applied to different ranges of products and services:

| Type of Good or Service | GST Rate (%) |

| 1. Cereals such as Wheat, Rice, etc. | 5 |

| 2. Soap | 18 |

| 3. Laptop | 18 |

| 4. Gold | 3 |

| 5. Automobiles (Cars, Motorcycle, etc.) | 28 |

| 6. Railway Ticket | 5 |

| 7. Furniture | 18 |

| 8. Fruits | 12 |

| 9. Washing Machine | 28 |

| 10. Smartphone | 18 |

| 11. Telecom Service | 18 |

| 12. Frozen Meat Products | 12 |

This table summarizes what is the GST in India applicable to some everyday items. While essential goods have 0-5% GST, luxury items attract higher GST, up to 28%.

GST Statistics in India and Collections

Initially, there were many skeptics regarding GST when it was first introduced. However, within a few years, this mode of revenue collection has started generating positive returns for both the authorities and members of the public. Below are some interesting facts about GST in India:

- Total GST collection surpassed 1.74 lakh crores in India during August 2024 to set a new record. (https://en.wikipedia.org/wiki/Goods_and_Services_Tax_(India)_Revenue_Statistics#Revenue_Collections)

- During the financial year 2023-24, GST collection grew over 12.5% when compared to the previous year. (https://pib.gov.in/PressReleasePage.aspx?PRID=2010615)

- More funds from GST are flowing to states, helping them improve their infrastructures such as roads, hospitals, etc.

- Tax evasion is lowered due to GST, as all sales are now tracked and recorded electronically.

- In addition, Compliance for businesses has become more accessible due to the presence of one tax and standardized paperwork in the country.

It is remarkable how, within a few years, GST has become synonymous with success in India. The reforms being implemented under “one-nation-one-tax” have led to benefits for both government and citizens alike, contributing towards the economic growth of the nation. What is Make in India intiative?

GST – Key Challenges

Even though GST has made taxation easier in India, there were some obstacles during its early days.

- The glitches related to technology in the GST website and the e-Way Bill system made return filing difficult.

- Frequent changes in GST rates have created confusion among taxpayers and traders.

- There was also more expense for small businesses due to compliance necessities such as invoices and documents.

- Most states faced reduced revenue collection than expected during the first few months.

As time has passed and with changes in place, many of these problems have been solved, but there is still more to be done so that there will be a properly functioning GST system.

GST- A Single Tax System

We have learnt what is GST in India with example that it is a single and unified indirect tax on the manufacture, sale, and consumption of goods and services in India. It aims to make India a common market with common tax rates all over. While not perfect, GST is helping reduce tax burdens for businesses and simplifying India’s complicated indirect tax system for both companies and customers.

Swetha is a Content Specialist, LinkedIn Branding and B2B Marketing Consultant. When she is not in the world of B2B, she researches the roots and beauty of Indian Culture and Traditions. She is the author of the book: 365 Days 365 Posts – The Guide to LinkedIn Personal Branding, available exclusively on Amazon. Connect with her on LinkedIn.